Commercial models (sometimes known as ‘pricing models’) define how you capture value in your business. The model you adopt doesn’t just have significant implications for customer’s purchasing decisions, but also their behaviours, your brand, profitability and ability to compete.

While commercial models have evolved over the years, they’ve remained primarily internally focused by seeking to make sure that each customer is profitable. Indeed, there are questions about how far the commercial models in use have moved on from the inflexible, unresponsive and largely discredited ‘cost-plus’ approach.

Opening up new possibilities

Businesses are progressively shifting towards commercial models that charge customers for the value they receive and perceive rather than the cost structure. These developments give you the opportunity to take a more strategic approach to pricing by broadening the scope of value capture, while being more flexible in adapting to the changing competitive landscape.

These new and evolving forms of pricing have manifested themselves in four trends, each of which has advantages depending on the market dynamics:

Trend 1: From product to service (expanding revenue streams and value capture)

Charging customers for a service rather than the one-off product sale continues to gain ground. Along with the product itself, customers benefit from support, maintenance and upgrades as part of the offering.

Example:

- Printers which have moved from provision of hardware to all the services elements you require including hardware, software upgrades, ink and maintenance

Advantages:

– Strengthens relationship between supplier and customer, while avoiding the need to simply compete on one-off price

Trend 2: From upfront payment to subscription (aligning when and how you charge)

The second trend is closely related to the first. Indeed, the two trends are often merged as part of what has come to be known as the ‘subscription economy’. This model has clear advantages for customers by allowing them to try the service without having to commit the full lifetime cost upfront.

Example:

– Whilst streaming and software services are most common, we are observing the trend taking prominence by leading coffee chains

Advantages:

– Aligns pricing with the timing of value realisation (i.e. point of sale/use), while allowing for regular upgrades and creating more reliable and predictable revenue streams

Trend 3: From cost to value (aligning pricing mechanism with realisation)

These commercial models align pricing most closely with the value delivered to the customers, including how much they use the product and how well it performs.

Example:

– Pay-as-you-drive car insurance or broadband services that reduce charges if speed and other performance benchmarks aren’t met

Advantages:

– Maximises extraction of revenues, while giving customers an element of control

Trend 4: From aggregated to disaggregated (stripped down versions with strong upsell)

The last of the four major trends strips the offer down into its component parts and allows customers to pay only for what they use. One of the key drivers is price comparison sites, which increase consumer visibility and price competition. The disaggregated model allows companies to compete hard on the core element such as the vehicle insurance or airline flight, while looking for opportunities to upsell in higher margin areas such as additional legal cover or food, drink and duty-free products while flying.

Example:

– no-frill low cost airline model with increasing adoption by premium providers, charging for seat type, check-in baggage, airport check-in

Advantages:

– Customers pay for what they want while still opening up opportunities for higher margin upselling

Choosing the model that’s right for you

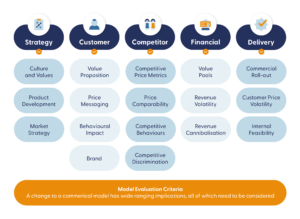

17 factors to consider

When judging the right model for a client, we assess the suitability, advantages and disadvantages against 17 determining factors.

The result is an aggregate score that identifies which model is better than the others. There will never be an exact fit – even the most suitable model needs to be implemented and managed effectively to realise the full benefits.

One of these trends – or a combination – will be more appropriate than another. So how do you choose?

1. Aligning value

A good starting point is to ask: “How well aligned is my value capture and the value customers realise?” Do prices and margins reflect the true value you deliver, for example? Are there big variances between customers? The closer the price is to the value you create, the more value the commercial model will generate.

2. Reflecting competitive dynamics

The second key consideration centres on whether the model reflects your competitive strengths. For example, it’s important to consider what you charge says about your organisation and its brand. It’s also important to judge whether the model focuses sufficient attention on your strengths (e.g. customer service or product innovation).

3. Aligning customer and company benefits

The other key priority is determining whether the model encourages customers to realise value (i.e. get what they paid for) while also managing their impact on your costs. Are you providing the right customer incentives, for example? How easy is it for customers to transact with the model? Could your model actually encourage customers to consume more than they’re paying for?

There are a number of guiding principles that can help you to address these questions:

– Clarity: Customers want to know what they’ll get, how much they’ll pay and be able to compare prices. That includes having a common denominator for comparison and being able to weigh up the opportunity cost

– Time: Customers don’t want to spend too long working out what they’ll pay, what they’ll get and how to transact

– Fairness: People have a strong and intrinsic sense of what price and value for money is fair and what isn’t. You break the fairness rule at your peril

Reaping the rewards

So choosing the right commercial model isn’t straightforward, especially as the right one for your business might be a blend of different options. But with a structured approach to evaluation, you can come to an informed choice that can not only boost your margins, revenues and returns, but also strengthen your competitiveness, customer engagement and ability to invest for the future.